Medicare Supplement (Medigap) Plans in Maine for 2026

A York County Cost & Carrier Comparison

If you're a Maine senior exploring your Medicare options beyond Medicare Advantage, you've likely heard about Medicare Supplement plans, also known as Medigap. While Medicare Advantage is about managed care networks, Medigap is about freedom and predictability. For many in York County and beyond—whether you split your time between Kennebunk and Florida, prefer seamless access to specialists at MaineHealth, or simply want the peace of mind of fixed costs—a Medigap plan can be the ideal long-term solution.

But here's the critical Maine-specific detail many miss: While the benefits of each Medigap plan letter (like Plan G) are standardized by the federal government (mostly), the monthly premiums are not. The cost for the exact same coverage can vary dramatically between insurance companies and even between neighboring towns in York County. This guide will cut through the complexity, providing a clear 2026 comparison to help you find the right balance of coverage and cost for your life in Southern Maine.

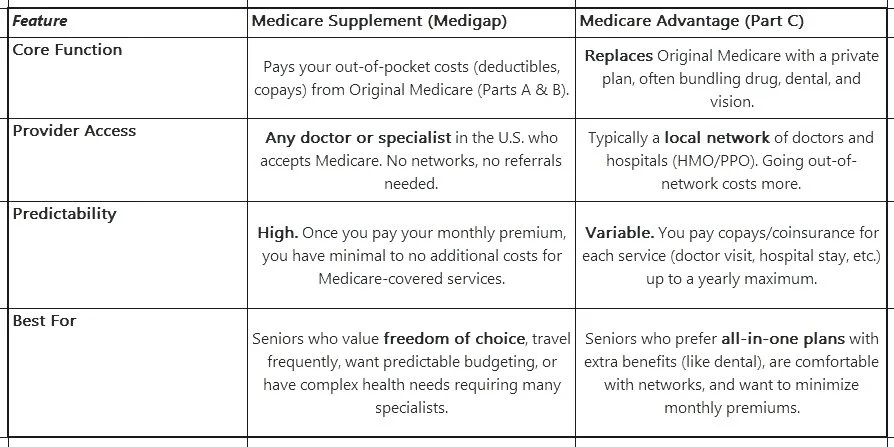

Medicare Supplement vs. Medicare Advantage: Two Paths for Maine Seniors

Choosing between these two options is the most significant Medicare decision you'll make. It's not just about price today; it's about your healthcare style for the next decade or more.

The Maine Lifestyle Test: Do you winter out of state? Do you have a vacation home? Do you want the flexibility to see any specialist at Massachusetts General Hospital or in-network at York Hospital without a referral? If yes, Medigap's freedom is a powerful fit.

Why Medigap Is So Popular in Maine?

Maine’s geography plays a bigger role in Medicare decisions than most people realize.

We’re a large, mostly rural state

Many people travel for specialty care (Portland, Boston, out of state)

Provider access can change depending on where you live

Networks can be limiting, especially with some Medicare Advantage plans

With Medigap:

You’re not tied to a local or regional network

You can go to MaineHealth, Northern Light, all the Boston hospitals, or anywhere else that takes Medicare

You don’t need to worry about “is this hospital in my plan’s network?”

For many York County residents who travel, split time between states, or just want maximum flexibility, Medigap is the cleanest and most predictable setup.

The 2026 Medicare Supplement Plan Landscape: Understanding Your Letters

As of 2026, the most popular and comprehensive plans available to new enrollees are Plan G and Plan N. They are standardized—a Plan G from Company A has the exact same benefits as a Plan G from Company B.

Medigap Plan G (Most Comprehensive): Covers all Medicare-approved medical costs after you pay the annual Part B deductible ($240 in 2026). After that, it pays 100%.

Medigap Plan N (Cost-Sharing Option): Also covers most medical costs, but you pay a copay of up to $20 for doctor visits and up to $50 for emergency room visits (if not admitted). It does not cover Part B excess charges (rare in Maine but possible).

Why Focus on G and N? For those new to Medicare after 2020, Plan F (which covered the Part B deductible) is no longer available. Plan G is now the most comprehensive option, and Plan N is a popular lower-premium alternative. For those who attained Medicare before 1/1/2020, plan F is still and option, but fiscally may not make sense, as plan G is so similar.

The York County Cost Reality: Premiums Are Not Created Equal

This is where your local agent's insight is crucial. Insurers set premiums based on three main methods, which affect long-term costs:

Community-Rated: The same premium for everyone in a geographic area, regardless of age. Premiums only go up due to inflation.

Issue-Age-Rated: Premium is based on your age when you first buy the policy. Younger buyers lock in a lower rate.

Attained-Age-Rated: Premium starts low but increases every year as you get older, on top of inflation. This can become very expensive over time.

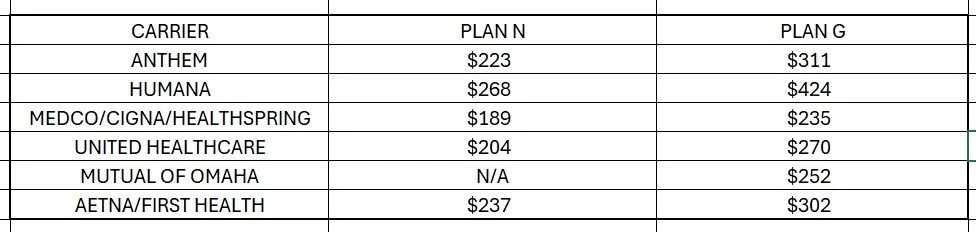

Sample 2026 Monthly Premium Ranges in York County:

*(These are illustrative estimates for a 65-year-old non-smoking female in ZIP code 04043. Actual quotes vary.)*

These are only estimates, based on the State of Maine website: https://www.maine.gov/pfr/insurance/node/927

These do not reflect any additional discount like multi-insured discount, room-mate discount, automated payment discount, and others based on each individual carriers rules.

The Critical Factor: The Underwriting Hurdle

Unlike Medicare Advantage, which has annual enrollment with no health questions, applying for a Medigap plan outside of your 6-month Open Enrollment Period (which starts the month you're 65+ and enrolled in Part B) usually requires medical underwriting. The insurer can review your health history and can deny you coverage or charge you more based on pre-existing conditions. This makes your initial enrollment decision a critical, time-sensitive one.

Leading Medigap Carriers Serving Maine in 2026

Aetna: A national giant with competitive rates and strong financial stability.

Anthem BCBS: The only Guaranteed Issue provider in the state. All offered plans, all the time. NO Underwriting! So more expensive!

Cigna: Often offers competitive pricing and a wide range of plan options. In some areas the least expensive option!

Mutual of Omaha: A historically strong player in the Medigap market known for customer service, and competitive pricing.

Maine-Based Carriers: Some local or regional insurers may offer Medigap plans. Their community-focused approach can be appealing.

Stability is Key: When comparing, look beyond just price. You're buying a policy you may keep for 20+ years. The company's history of rate increases and its financial strength ratings (from A.M. Best, Standard & Poor's) are vital. Because you cannot always get a plan, client tend to keep these like luggage!

Your 5-Step Checklist for Choosing a Maine Medigap Plan

Know Your Enrollment Window: Are you within 6 months of first signing up for Part B? If yes, you have guaranteed issue rights. If no, be prepared for underwriting.

Prioritize Your Needs: Is total predictability (Plan G) or lower monthly premium (Plan N) more important for your budget?

Compare the Same Letter: Only compare Plan G quotes to other Plan G quotes. The benefits are identical, so you're comparing company reputation and price.

Ask About Pricing Method: Always ask, "Is this policy issue-age, attained-age, or community-rated?" This tells you more about future costs than the initial quote. This is important in most states, but all of Maine is community rated.

Get Personalized Quotes: Premiums vary by age, gender, ZIP code, and tobacco use. A quote for your neighbor is not your quote.

Let's Find Your Maine Medigap Fit

Navigating the fine print of standardized plans and variable pricing requires a local guide. As an independent agent in Kennebunk, I work for you, not the insurance companies. I will help you:

✅ Decode the pricing models to find the best long-term value, not just the lowest teaser rate.

✅ Compare personalized quotes from multiple top-rated carriers serving York County.

✅ Navigate underwriting and ensure a smooth application, especially if you're outside your initial enrollment window.

✅ Understand the full picture of how a Medigap plan fits with your Part D drug plan and overall retirement budget.

Ready to secure your healthcare freedom with predictable costs?

📞 Call Jon Fitch for your free, personalized Medigap comparison.

📧 Email: jonfitch64@gmail.com

Serving seniors in Kennebunk, Kennebunkport, Arundel, Biddeford, Saco, Old Orchard Beach, Scarborough, Berwick, North Berwick, Wells, Ogunquit, York, Kittery, and all of York County. Plus 11 other states!

Note: All plan data, deductible amounts, and premium ranges are illustrative for the 2026 plan year and are subject to change. Premiums are specific to age, location, gender, tobacco use, and insurer. A personalized consultation and formal quote are required to determine exact costs and eligibility.

FAQ: Medicare Supplement Plans in Maine

-

The absolute best time is during your 6-month Medigap Open Enrollment Period. It starts the first month you're 65 or older and enrolled in Medicare Part B. During this window, you have a guaranteed right to buy any plan without health questions.

-

Yes, if you apply outside of your guaranteed issue periods (like your initial Open Enrollment or a special situation like losing employer coverage), insurance companies can use medical underwriting to deny coverage or charge a higher premium based on your health.

-

No. You must purchase a separate Medicare Part D prescription drug plan. I can help you bundle a Medigap plan with a Part D plan that covers your specific medications.

A bit of history: Plan letters H, I, and J were set up to include prescription coverage as well, but they were discontinued in 2006, with the creation of Prescription Drug Plans.

-

You must ask the agent or company directly. This information is crucial and should be clearly disclosed before you apply

-

You can try, but you will likely have to pass medical underwriting. There is no annual guaranteed enrollment window for Medigap. Switching from Advantage to Medigap is often much more difficult than the reverse.

-

Annual Guaranteed-Issue Period: Regardless of health, insurers must offer Plan A (and sometimes others) during a specific one-month period each year. Each carrier chooses their own month, often during the policyholder's birthday month or another assigned time.

Community Rating:Maine prohibits insurance companies from using age or gender to set premiums. All beneficiaries in a plan generally pay the same rate, though discounts for new customers or higher rates for tobacco use may apply.

Switching Plans (No-Gap Rule): You can switch to a plan with the same or lesser benefits (e.g., from Plan C to Plan A, B, or D) without medical underwriting, provided you have never had a gap in coverage exceeding 90 days since your Open Enrollment Period.

Medicare Advantage Trial Rights:If you switch from a Medicare Advantage back to Original Medicare, you have 90 days to buy a Medigap plan.

Under 65 Coverage:Maine provides guaranteed access to Plan A for individuals with disabilities under 65 during their initial enrollment and annually thereafter. Note: Just because it’s available, does NOT mean it’s affordable!

Free Look Period:Maine law provides a 30-day "free look" period to review a new policy.

Going back to a Medicare Supplement: If you are enrolled in a Medicare Supplement plan and you terminate that enrollment to enroll in a Medicare Advantage plan for the first time, and you then return to Original Medicare Part A and Part B within 36 months. In most states, it’s only 12 months!

Trying a Medicare supplement plan after a Medicare Advantage:If you enroll in Medicare Advantage during your six-month open enrollment period, beginning when you first enroll in Medicare Part B, and then switch to Original Medicare Part A and Part B within 36 months. In most states, it’s only 12 months!